This week I was trying to help a local Nonprofit organization set up a paypal account so that we could enable them to accept donations online. They already have a merchant services account for credit card transactions, which is probably charging them far more than they need to pay in order to maximize the benefits of their collections to those in need. PayPal for this nonprofit seemed like a natural fit.

However, when I went to set up their account, I rapidly realized that PayPal had done a large rewrite of their setup procedure for nonprofits. It was almost impossible to find the information in PayPal for nonprofits by doing searches in PayPal itself! After spending 45 minutes on hold, I was guided one click at a time to the nonprofit setup page for new accounts.

WARNING! If you work for a religious non profit, if you attempt to call PayPal it is likely that their phone menu system will drive you nuts and you might be tempted to utter blasphemy or its equivalent in your religion. You may want to remove yourself to a less public place before the phone menu system drives you to curse up a storm!

My goal is to to show you how to navigate PayPal’s nonprofit setup area so you can save yourself and your nonprofit 45 minutes of wasted time. (If you have not already established an official tax exempt nonprofit, you may choose to cover that step first.) Whether setting up a PayPal account is the right step for your organization is a different question. I’ve personally used PayPal for over 11 years. I am very happy with the service and the direction of improvements too. Here’s a couple thoughts to consider if you are still on the fence…

My goal is to to show you how to navigate PayPal’s nonprofit setup area so you can save yourself and your nonprofit 45 minutes of wasted time. (If you have not already established an official tax exempt nonprofit, you may choose to cover that step first.) Whether setting up a PayPal account is the right step for your organization is a different question. I’ve personally used PayPal for over 11 years. I am very happy with the service and the direction of improvements too. Here’s a couple thoughts to consider if you are still on the fence…

I will also share some information from PayPal about accepting donations from your Facebook page, which might prove very useful. I don’t work for PayPal nor their Nonprofit Section, but I did briefly meet their nonprofit person at Blogworld in 2010, and you can talk to them on twitter @PayPalNonprofit.

How to set up a PayPal for Non Profit Account to Accept Donations

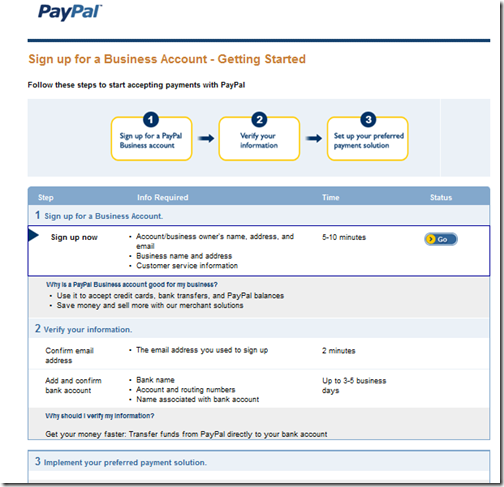

The general process to set up a Nonprofit account with Paypal requires multiple steps and probably can not be completed in a single session nor day. You will have to create a Business Account first, highlighting your non profit category during the setup form. PayPal will then contact you requesting information that proves your nonprofit status. Once provided you can then apply to PayPal to create a nonprofit account and you will then be allowed to receive donations via PayPal with the lower Nonprofit rates mentioned further below in the ‘How to Find general information about PayPal for nonprofit Accounts.

PayPal setup for non profits video tutorial

update- In 2012 PayPal streamlined a few steps. There are still a couple of tricky decisions so I put together this short 2 minute video showing how to setup a PayPal for nonprofit account. I recommend watching the video first. It may be enough to guide you through the steps, if not you can use the step by step guides below.

(updated images coming below soon).

Initial steps to setup PayPal for Nonprofit Groups

1. Click here to Go to PayPal’s home page

2. Click on the Sign Up link at the very top of the page

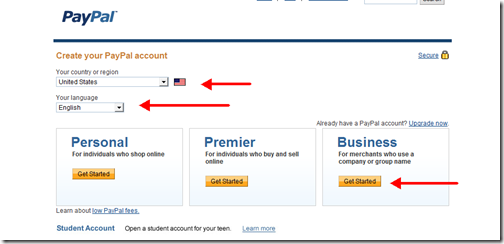

3. Confirm or change the country and language options as needed and then Click the Get Started Button in the Business Section (the Personal and Premier options are only for individuals. Individuals cannot be non profits, even if they are unprofitable!)

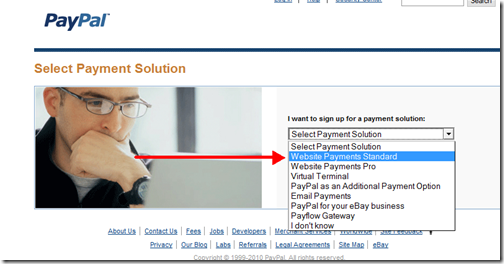

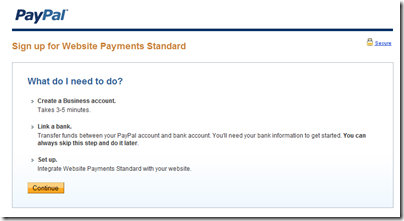

4. From the next Web Payment Solution Form Screen provided next, choose

This is the base level account and as you will have to go through the confirmation phase with a PayPal representative anyway this is the best place to start, if you need additional or higher level services, these can be added or adjusted later, but they typically can not be chosen first. Get your non profit designation confirmed with PayPal before you attempt to do anything else.

5. Depending on your Browser or how many times you might have explored the PayPal site the next screen you see may give an outline of the sign up steps to follow, Click the GO button (or possibly the Continue button) to proceed

alternate screen if you have started this step once before in the same browser and PayPal remembers you

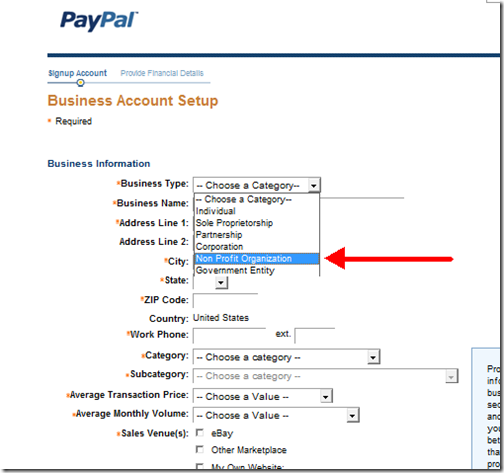

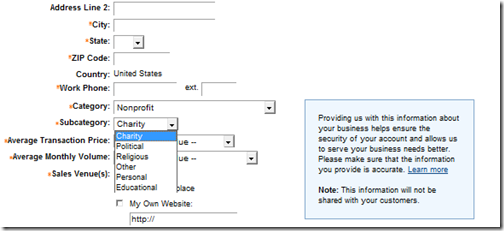

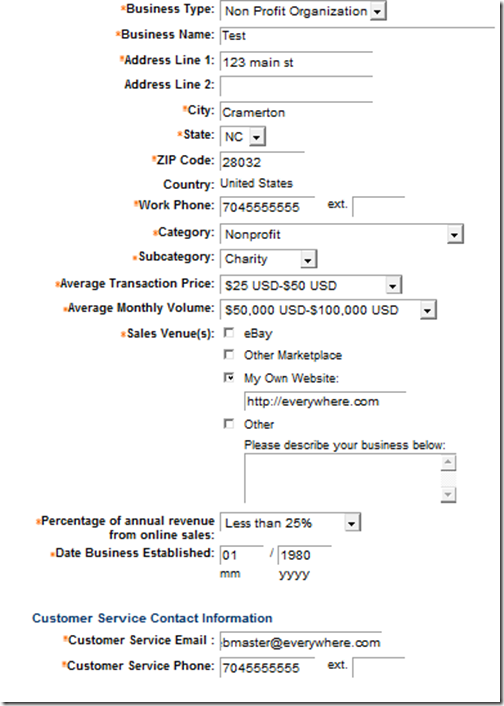

6. Start completing the application form by choosing your Organization type, I won’t tell you how to fill out your name and address, but DO pay attention to the Business Type and Category and Sub Category fields as they are VERY important for Non Profit Consideration

7. Don’t worry too much about the amount sections of the form, use conservative numbers especially if your non profit has never collected money online via donations before, better to start at $0 and work your way up rather than set unrealistic expectations.

8 Hit Continue

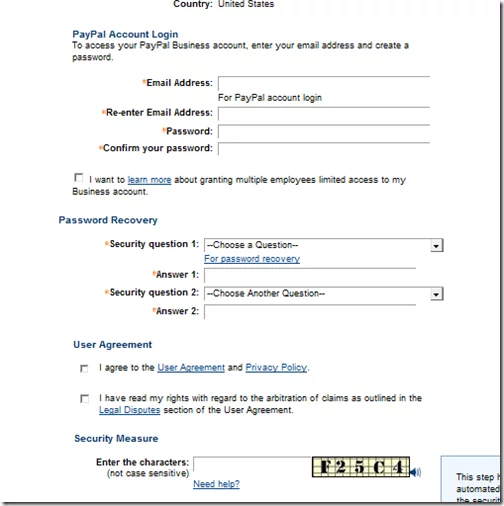

9 You will now need to enter some information that will create your PayPal account. Tips! Use an official email address for your organization for someone that DOES check their email regularly and DOES have authority from your treasurer or equivalent. You can add other email addresses later if necessary, including generic email addresses to be used on your website.

10. After you hit Continue again, You will need to link up your checking account and then you can proceed to wait for PayPal to begin processing your account setup and application. They will send you a request of the additional information that they need which will include proof of your non profit status.

How to FIND general information about PayPal for Nonprofit Accounts

1. Go to PayPal’s home page

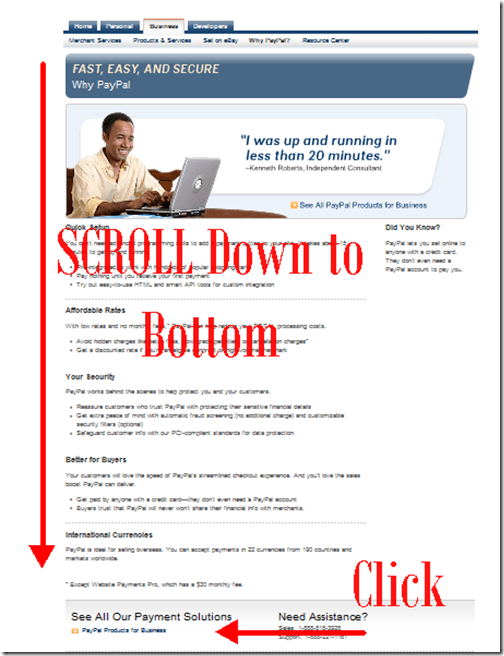

2. Click on the Business Tab

3. Click on the Why PayPal Tab?

4. Scroll down to the bottom of this page and click on the link PayPal Products for Business (yes I know we’re talking about a Nonprofit sign up but hang in there PayPal isn’t organized terribly well, they seem to consider a Nonprofit as a type of account within their business account category, probably a programmer thing.)

5. Scroll down again and see the links at the bottom for Nonprofits and Political Campaigns (click which ever is appropriate!)

6. IF AND ONLY IF you already have a PayPal account for your organization you may wish to Click ‘Try it Now’ (after investigating the information provided) in order to create a button (if you already have an account) This silly button will only walk you through an example of how you might create a donation button if you actually had an account but WILL NOT set up an account for you.

How much are PayPal Fees for Nonprofit Accounts?

PayPal Fees for Nonprofits is Cheaper. There are only two tiers and they are priced as follows:

| YOUR MONTHLY DONATIONS | Nonprofit PayPal FEE PER TRANSACTION | EXAMPLES |

| $0 to $100,000 | 2.2% + $0.30 | $2.50 fee on a $100 PayPal donation |

| $100,000+ | 1.9% + $0.30 | $2.20 fee on a $100 PayPal donation |

*PayPal pricing tiers normally start off at 2.9% and only drop down to 2.2% after a $10,000 threshold is reached.

How do I accept Credit Cards in the office or Over the Phone for my Nonprofit?

PayPal has a separate service called Virtual Terminal for processing credit cards over the phone or in person. The account type of above would be used on the web only where a person comes to your site, clicks the donate button then fills in their credit card information themselves.

Under the virtual terminal program, a person might recite their credit card information to one of your employees over the phone and that employee would enter the information into the virtual terminal to process the credit card transaction.

Virtual Terminal is considered and add on or extra service and there are no discounts for Non Profits for this Add on.

Virtual Terminal has a fixed monthly fee (think of it like a subscription fee). That monthly fee is $30 whether you process transactions or not.

The ratable fees vary depending on the size of the transaction as follows

You pay only one $30 monthly fee and 2.4% to 3.1% plus $.30 per transaction based on your monthly processing volume.

There are no set up or cancellation fees and no long term commitments.

| YOUR MONTHLY DONATIONS | PayPal FEE PER TRANSACTION | EXAMPLES |

| $0 to $3,000 | 3.1% + $0.30 | $3.40 fee on a $100 sale |

| $3,000+ to $10,000 | 2.7% + $0.30* | $3.00 fee on a $100 sale |

| $10,000+ | 2.4% + $0.30* | $2.70 fee on a $100 sale |

The pricing table above applies to domestic payments in US dollars. There’s an additional 2.5% charge for any currency conversion and a 1% charge to receive payments from another country.

So if you set up a non profit account and Virtual Terminal any charges that take place on your website would be processed at the lower/cheaper rates and any that were processed under virtual terminal would be at a higher rate. This would give you an incentive to push your donors to use online tools as opposed to over the phone or in person donations where it is practical or possible even if that means setting up a computer terminal for donors to utilize or a terminal at an event. If it saves you 0.5% – 0.9% on a donation, that might be worth a few hundred dollar investment in an extra PC with internet access, but do make the financial review yourself first.

What Documents will PayPal need to Confirm my organization’s Nonprofit Status?

For a U.S. based tax-deductible and tax-exempt organization, you’ll need

to fax:

- Evidence of tax exempt status or registration with any applicable

regulatory bodies, such as a §501(c)(3) Determination Letter

OR

- Proof of tax-deductibility with a subordination letter, illustrating the

account as a child of a larger, more national organization.

AND

- A copy of a bank statement or voided check or cheque. The document must

include:

Your organization name and address pre-printed on it from each bank

account that you intend to add to your PayPal account.

Each bank account that you add to your PayPal account must be under the

ownership of the organization and cannot be a personal bank account.

- If this is a tax-exempt only organization, you’ll need to provide:

Evidence of tax registration status and/or registration with any

applicable regulatory bodies governing your jurisdiction.

OR

- Subordination letter, illustrating the account as the child of a larger,

more national organization.

AND

A copy of a bank statement or voided check or cheque. The document must

include:

- Your organization name and address pre-printed on it from each bank

account that you intend to add to your PayPal account. - Each bank account that you add to your PayPal account must be under the

ownership of the organization and cannot be a personal bank account.

Any non-U.S. based organizations will need to provide:

- Evidence of tax-exempt status and/or registration with any applicable

regulatory bodies governing the organization’s jurisdiction. - A copy of a bank statement or voided check (cheque) with the

organization name and organization address pre-printed on it from each

bank account that the organization intends to attach to the PayPal

account (if applicable). - Link to confirm the organization’s registration status online (if

applicable). - A brief organizational summary or Mission Statement.

Subordination letter from the parent organization (if applicable).

All documents should be faxed to 303-395-2862, ATTN: Compliance – Due

Diligence. Please remember to include your email address as registered

on your PayPal account on any correspondence or faxed items.

Here’s how to find more information on nonprofits:

- Go to the PayPal website and log in to your account.

- Click “Business” at the top of the page.

- Click “Nonprofits” at the top of the page.

How do I sell tickets to events?

Enabling people to register for your non profit events via Eventbrite is one of the easiest and fastest ways to get started. Eventbrite manages all the software for managing event registration. You can easily setup an account quickly, then copy paste a widget to your own wordpress powered website that will manage the registration process from your site using eventbrite tools for you. Eventbrite does take a commission of the ticket sales, so you have to make certain that the net fee you receive covers your costs and contribution goals. That cost is the trade off you make for saving money and time creating, developing, rolling out, and maintaining an independent web system.

How do I Accept Donations on my Nonprofit Facebook Page via PayPal?

New Facebook fund raising Donation Service

Since writing this article, I learned of a new service FUNDRAZR.COM which provides a very unique capability to non-profits raising funds or donations through Facebook. Essentially, you can create a fund raising box, that you can post to your wall (like any update). Your friends or fans can then share this same box, so that their friends can see it.

Anyone that sees it on your wall or on someone else’s wall can donate directly to you through the box!

The normal per transaction fee increases from $0.30 to $0.60 when using this service, but I believe the percentage rates for normal accounts or even the cheaper non profit paypal accounts stays the same.

No setup or monthly charges. 2.9% + $0.60 USD per transaction (ex: $3.50 fee on a $100 donation).

Furthermore, you can even include an image, graphic or YouTube video in this box relatively easily to help communicate more information about the fund raising campaign in question. This promises to be a very useful tool for non profits raising donations through Facebook! (I just wish they had a WordPress plugin too)

Alternatively you might consider setting up an account with PayPal’s partner site WhatGives.com, note as of 10-6-2010 this service was in the middle of updating its application to continue working with Facebooks recent api changes and as of 3-4-2012 it looks pretty cool and easy again. (I will probably cover this again in more depth later).

8-25-10 update

This month as I help a client prepare for their first event utilizing the tools above we noticed a couple things that will be important to your own non profit organization’s success at fund raising online with pay pal.

The number of page views on your site will likely increase after you add the capability to your site to take donations or process event registrations. Quite simply, your site starts to transform from simply informative to interactive. People start clicking and doing things on your website. This means an increase in page views and in aggregate this might increase the use of your server or hosting plan.

If you run a popular charitable event and process registrations (as we were) you may also notice a lot of activity as the event date gets closer. We saw a small but important increase in total traffic, but the interaction level was very high and started slowing down the load time of our site.

So I quickly deployed some of the tips I describe in a separate article about optimizing a wordpress site for page speed load times. At a basic level, I added a cache plugin and configured it, not a beginner step. I also installed a plugin I love called wp-smush-it. This little plugin processes images in your wp media library and makes the file size smaller so the images and pages they are on load a little faster.

Every bit counts, especially when you are trying to raise money through nonprofit PayPal donations, or process registrations through your new PayPal account. You want the check out process to run smooth and fast regardless of how many visitors are on your site and doing something!

This is a good challenge to deal with so don’t shy away from it.

9-26-11 Update

Nonprofit Donations on Facebook – 3 New Services for Charities!

Here are three additional services or ways to take PayPal donations via Facebook. I’ll mention up front that while they each have a do it yourself aspect to things, they seem to make some of their money from working with non profits. That’s not a bad thing if they help you get results cheaper and faster and more effectively than if you did it yourself.

All that said, its a new area and it is important to insure that you perform a little due dillegence on the cost of your pick and shovel before you head into the hills…

NADANU

Network for Good

Causes.com – a bit of a nonprofit social network that can make it easy to post things into facebook to get donations, but you can easily do that with your own wordpress powered site and a PayPal account too!

Artez Interactive @artezonline

Another firm that provides several services to take donations from a website, from mobile solutions and working through Facebook even with the Facebook Timeline capability. The site doesn’t make it easy to preview their services or what they do or offer. It has much more of a ‘2003’ corporate look and feel about the site requiring requests for demos and offering white paper downloads via pdf. From my previous experience in corporate finance vetting consultants these signals usually indicate lengthy engagements and higher prices. I could be wrong, just my impression but I would like to see a more open and modern website showing off their services from a company that proposes to do the same for others. My gut tells me that if you have a large organization and an old school director that needs likes to go to a meeting with an equal number of consultants on the other side of the table, this may be a good fit. If you want to keep your administrative costs as a percentage of donations down, there’s a lot of this I believe you could do elsewhere for far less.

Facebook may work for donations but Beware of ‘Selling’ as opposed to fund raising

Things are evolving quickly in the world of Facebook donations, facebook fund raising and Facebook ecommerce aka F-commerce. Many businesses (as opposed to charities or non profits on facebook) have found that there is not enough ROI on Facebook when it comes to setting up actual stores on Facebook itself. The consensus is that people want to communicate on Facebook with charities or companies or friends and family, but they do not necessarily want to shop there. See the ReveNews.com article Think Facebook Drives Sales? Think again

If we take a minute to absorb and understand that epiphany, it is not very surprising. Yes people want convenience but not at the sacrifice of a good user interface and not a facebook interface over a highly evolved shopping cart system that customers are already familiar with using.

That does not mean that charities or non profits should avoid fund raising through Facebook. It is very different to highlight a timely or current cause or campaign and then make it easy for people to pledge or donate as opposed to trying to setup an ecommerce store on facebook with thousands of products to navigate. Facebook for nonprofit activities can have a goal of raising money just like PayPal for nonprofit, but the primary goal on Facebook should always be communications, awareness, building a relationship and only making it easy to raise funds or pledges once people are comfortable with your organization or cause.

Those are all things most charities are naturally inclined to do as opposed to retailers who are more naturally inclined to market a single product, only possibly creating a generic ’cause’ in the form of a sales event or leveraging a holiday. The inherent artifice of retail is a Facebook obstacle, where as the inherent relationship and communication between a non profit or charity and their community is a Facebook Strength.